In our previous post Our Credit Card Strategy 2024, we introduced a simple beginner-friendly 2 plus 1 card strategy featuring the Amaze + Citi Rewards combo for offline spending and the DBS Women’s World Mastercard for online spending. Today we will be sharing with you an upgraded version of the strategy that will allow you to earn even more miles without limitations!

Citi Rewards Card

Pros:

- Online Spend: Earn 10X points (equivalent to 4 miles per dollar) on a wide range of online purchases. Some travel-related expenses like flights and hotels may not qualify for the bonus rate.

- Long Expiry: Points are valid for 3 years, giving you plenty of time to accumulate and redeem them.

- $1 Blocks: Points are earned in $1 increments, making every dollar count toward your miles.

- Flexible Transfer Partners: Citi ThankYou points can be converted to airline partners such as KrisFlyer.

- Citi PayAll: Owning the Citi Rewards Card provide you with access to Citi PayAll, a feature that allows you to earn points while paying bills like rent, school fees, or insurance premiums, for a fee.

Cons:

- Offline Spend: Without a workaround, offline purchases only earn 0.4 miles per dollar. You can bypass this by linking it to the Instarem Amaze card, which converts offline transactions into online ones for 4 miles per dollar.

- Travel Category Excluded: You can earn bonus miles on all categories except travel. Read on to find out which card we recommend you to get to rack up miles on your travel-related expenses!

- $1,000 Monthly Cap: The 10X points apply only to the first $1,000 of online spending per statement cycle.

For the most accurate and current details, refer to the official Citi website here.

Instarem Amaze Card

The Instarem Amaze card can be paired with your Citi Rewards card to transform offline purchases into online ones, helping you earn the full 4 miles per dollar even for in-store transactions.

Pros:

- Pay Less For Miles: Amaze lets you save on foreign transaction fees as compared to most credit cards (the FX spread on Amaze is typically >2%, while most cards charge >3%). This means that you are paying less per mile when you pair the Citi Rewards card with Amaze and tap your Amaze card instead.

- InstaPoints Rebate: On top of earning miles, you also receive SGD 0.5 InstaPoints on every SGD 1 spent in foreign currency (up to 500 InstaPoints a month), which can be converted to $5 to be used in your Amaze Wallet.

- Maximize Online Rewards: Even offline purchases count as online, so you can continue earning 4 mpd for those transactions.

Cons:

- Mastercard-Only: You can only link Mastercard credit or debit cards to Amaze, so it won’t work with Visa or American Express cards.

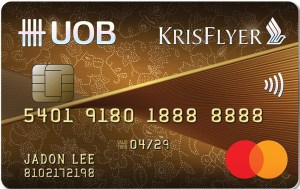

UOB KrisFlyer Credit Card

When it comes to travel, the UOB KrisFlyer credit card is the go-to option for maximising miles on both flights and accommodation. It offers 3 miles per dollar (mpd) on travel-related purchases such as flights, hotels, and Airbnb bookings.

Unfortunately, with the recent updates from UOB, the UOB KrisFlyer Credit Card can no longer earn extra rewards when paired with the Instarem Amaze card on offline and overseas spending. Here’s a breakdown of the key pros and cons to consider with this card now:

Pros:

- 3 Miles Per Dollar (mpd) on Travel: Earn 3 mpd on Singapore Airlines Group transactions (Singapore Airlines, Scoot, SilkAir, KrisShop)

- More Categories: As long as you hit the annual $800 minimum annual spend on Singapore Airlines Group transactions, you can also earn 3 mpd on dining, online shopping, food delivery, online travel and transport categories. Milelion has an excellent post with a detailed breakdown and explanation of this here.

- No Cap on Miles: Unlike many cards with monthly reward limits, there’s no cap on how many miles you can earn for qualifying transactions.

- Easy Krisflyer Miles: Perfect for those who frequently fly with the Singapore Airlines group and want to earn Krisflyer miles.

Cons:

No more Pairing with Instarem Amaze: The card can no longer be paired with the Instarem Amaze card for additional rewards on offline and overseas spend from 1 Oct 2024 onwards.

Delayed Miles Credit: You only receive 1.2 mpd upfront, with the remaining 1.8 mpd credited directly to your Krisflyer account two months after your the end of your membership year.

Bonus Tip:

If you find it difficult to hit the $800 minimum spend annually yourself, consider offering to book flights for friends or family and pay first using this card!

How to Maximise Miles?

- Citi Rewards Card: Use it for online purchases (except travel) to earn 4 mpd and pair it with your Instarem Amaze card to earn 4 mpd on offline purchases, up to a maximum of $1,000 spend per month.

- UOB KrisFlyer: Use this card for travel expenses and Singapore Airlines Group transactions, as well as dining, online shopping, food delivery, online travel and transport to earn 3 mpd unlimited.

How to Apply?

Look out for the best sign up offers for Citi Rewards and UOB Krisflyer by comparing between sites like Singsaver, Moneysmart and on Citi’s/UOB’s websites. The third party sites usually offer free products as rewards, while signing up with the bank typically rewards you bonus miles.

If you are looking to sign up for the Amaze card, you can use this referral link to receive 200 InstaPoints as a welcome gift: https://referral-link.onelink.me/gbf1/a43c48ca?referral_code=4MkMm5, and I will likewise receive 200 InstaPoints too.

Conclusion

As you embark on your journey to earn miles through credit cards, remember that every small step counts. Be sure to check back on our blog for more tips, insights, and strategies to maximize your rewards – happy travels ahead!

Keep the Change

Tine & Hao

![[Upgraded] The 2 plus 1 card strategy to earn miles](https://keepthechangektc.com/wp-content/uploads/2024/09/4.png?w=1024)

Leave a comment