So, you’ve decided to dip your toes into the world of miles, but now you’re wondering which card to apply for first? If you’ve seen our previous posts on earning miles and checked out our card recommendations, great! If not, here are some practical questions to guide you along:

- Upcoming Big Expenses?

Are you planning a wedding, home renovation, or a big trip? It’s the perfect time to start earning miles on these significant purchases. Why not get something extra when you’re already spending big?

- Review Your Spending Habits

Monthly Spending: Do you have a consistent monthly budget, or does your spending vary wildly from month to month?

Offline vs. Online Spending: Do you primarily use your card for in-person transactions or online purchases?

Spending Categories: Consider what you spend the most on—whether it’s dining out, shopping, travel, groceries, or something else.

- Sign-Up Offers

Do you prefer to get extra miles, cash or rewards? Directly signing up on the bank’s website often gives you rewards in the form of miles. Look out for promotions on comparison sites like MoneySmart or SingSaver if you prefer cash or physical rewards. Many banks offer enticing sign-up bonuses especially for new-to-bank customers.

These questions should help you narrow down your options and find the right card to kickstart your miles accumulation journey.

Recommendations for First-Time Card Applicants:

For Wide Category Coverage and Payment Flexibility

Citi Rewards + Amaze Instarem: As mentioned in our previous post, this pairing achieves the greatest coverage. It allows you to spend both offline and online across all categories (except Travel). This combination offers excellent versatility.

For Specific Category Spending

UOB Lady’s Card: Despite its name, it’s open to both men and women. Perfect if a particular spending category dominates your monthly expenses. You have to select one category among Beauty & Wellness, Fashion, Dining, Family, Travel, Transport and Entertainment to earn bonus miles per quarter.

In our case, we chose Travel as the category and used the card to pay the hotel for our wedding banquet monthly. After the wedding, we switched the category to dining as it represents a large portion of our monthly expenses. Did you know that for UOB One account holders, spending on the UOB Lady’s card helps to meet the $500 monthly spend requirement to earn bonus interest?

For In-Person Spending

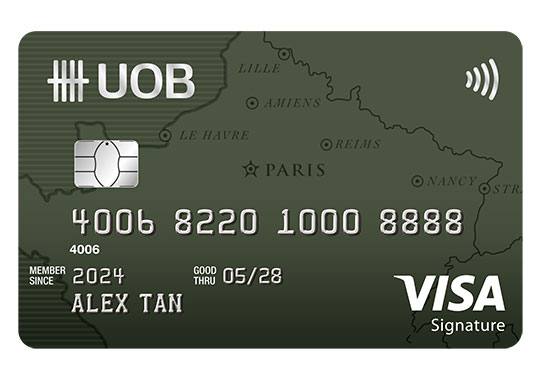

UOB Preferred Platinum Visa or UOB Visa Signature: Choose UOB Preferred Platinum for a straightforward, no-frills in-person spending option. Opt for UOB Visa Signature if your monthly spending exceeds $1,000.

Do note that for the UOB Preferred Platinum Visa, you will not earn bonus miles if you tap the physical card! You have to add it to your preferred (no pun intended) mobile contactless payment method (e.g. Apple Pay or Google Pay) and pay via your phone/watch instead.

For Online Spending

DBS Women’s World Mastercard: A straightforward card tailored for all your online expenses. Note that DBS points expire after one year, so do remember to convert your DBS points to airline miles within a year.

For Big Spenders

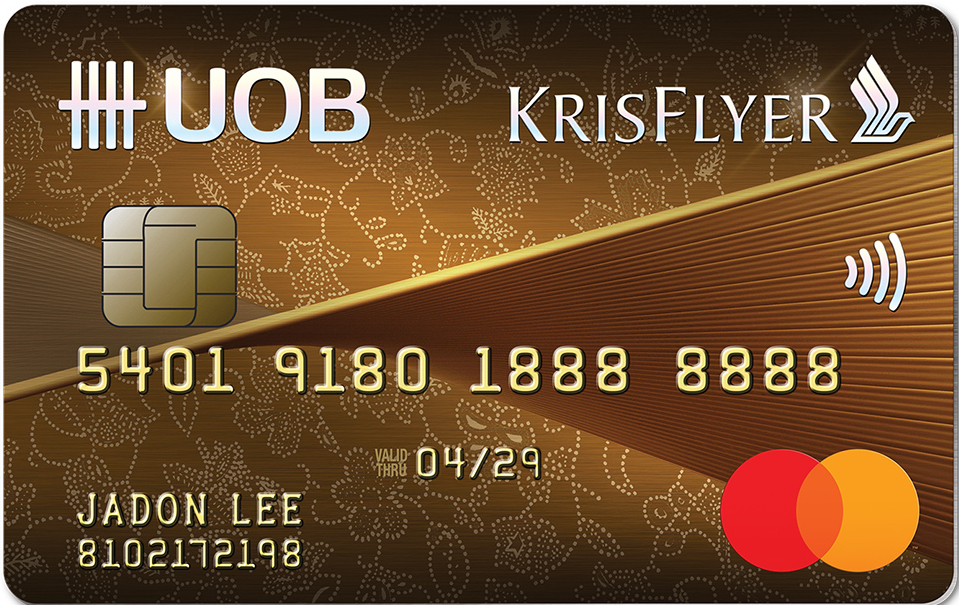

UOB Krisflyer Card: Upon spending S$800 on Singapore Airlines Group related card transactions in a card membership year, you will be eligible for unlimited 3 mpd on dining and online retail, suitable for high spenders. Pair this with the Instarem Amaze card to convert offline retail purchases to online. For a list of whitelisted spend, refer to the T&Cs.

Personal Recommendation

Citi Rewards + Amaze Instarem: Our top choice if you must select just one. This combination offers excellent coverage across different spending categories, both online and offline.

Simply link your Citi Rewards card to your Amaze card and use the Amaze card for all purchases except those in the travel (flights, hotels, activities) and transport (bus, MRT) categories. For more details, refer to the exclusion list.

You can check out the current sign-up offers for the Citi Rewards Card here:

If you’re looking to sign up for an Amaze card, you can apply using our referral link here and receive 200 InstaPoints!

Choosing the right credit card is like picking the perfect travel buddy for your miles-earning journey. Match your card with your spending habits and preferences, and you’ll be racking up rewards in no time! We hope these tips and recommendations help you to embark on an adventure filled with exciting rewards and unforgettable travels!

Keep the change,

Tine & Hao

![[Upgraded] The 2 plus 1 card strategy to earn miles](https://keepthechangektc.com/wp-content/uploads/2024/09/4.png?w=1024)

Leave a comment