Hey there, fellow travel and miles enthusiasts! If you’ve been following our blog, you know we cashed in a ton of miles from our wedding to snag a pair of return business class flights on SQ. Now, let’s dive into how we kept racking up miles overseas on our epic 18-day honeymoon road trip in New Zealand. We’ll show you the credit cards we used, our budget breakdown, and how we squeezed every last mile out of each purchase.

Cards we used

| Card | Monthly Spend Cap | Miles Per Dollar | Payment Modes and Categories* |

|---|---|---|---|

Citi Rewards Card | S$1,000 | 4 mpd | All online payments (except Travel) |

DBS Women’s World Mastercard | S$1,500 | 4 mpd | All online payments |

UOB Visa Signature | S$2,000 | 4 mpd | All contactless payments |

UOB KrisFlyer Card | Unlimited | 3 mpd | Dining, online shopping |

AMEX Platinum Charge Card | Unlimited | 0.95 mpd | All payments |

| Bonus: Instarem Amaze  | – | – | – |

*Standard exclusions apply. Refer to the full T&Cs from each bank for specific payment modes and categories accepted.

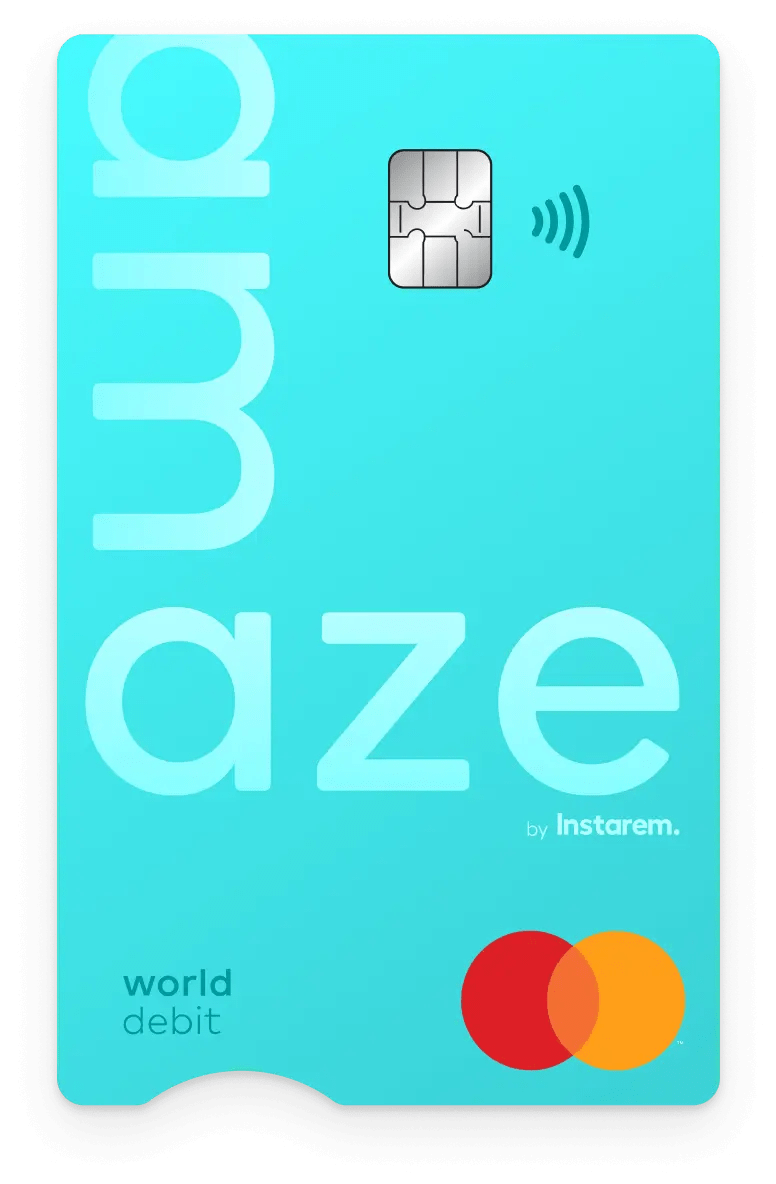

Why you need an Instarem Amaze Card

Batman has Robin, Tom has Jerry, and Citi Rewards/UOB KrisFlyer cards have Instarem Amaze. While this card is often known as a multi-currency debit card for traveling, it’s also a secret weapon for miles chasers.

While the Citi Rewards Card offers a stellar 4 mpd earn rate, it’s limited to online payments (excluding Travel). But with the Amaze Card, you can extend this benefit to offline payments (contactless) by linking it to the Citi Rewards Card and setting it as the default for transactions made with Amaze.

When you make a payment in foreign currency with the Amaze Card, it automatically converts the amount to SGD and then charge to your linked Citi Rewards Card. In addition, if you made a contactless payment in person, Amaze automatically converts it to become an online payment, making it eligible for online spending bonuses like with the Citi Rewards Card.

For the UOB KrisFlyer Card, although Amaze imposes a 1% fee on SGD transactions exceeding S$1,000 per month, this fee doesn’t apply to foreign currency transactions. Linking the UOB KrisFlyer Card with Amaze converts all offline retail purchases to online shopping, making them eligible for the uncapped 3 mpd earn rate.

Though we’ve only touched on the key features in this post, the Amaze Card has many more functions and benefits that deserve a separate post. Stay tuned for more details!

Our Honeymoon Budget Breakdown

We spent a total of S$10,000 (figures rounded off) on our honeymoon, and here’s how it was split by category:

- Accommodation: S$3,200

- Activities: S$300

- Dining and Groceries: S$1,900

- Shopping and Gifts: S$2,200

- Travel: S$2,400

Accommodation

We stayed at a mix of hotels, motels, lodges, cabins, Airbnb (9 in total). For reservations that required online payment upfront, we used the DBS Women’s World Mastercard. As for bookings that allowed us to pay at the counter upon check in, we used UOB Visa Signature to make in-person payments.

Activities

Most of our activities were in fact free (think hiking, driving along scenic routes). For the few activities that we had to pay for, we used Citi Rewards paired with Amaze.

Dining and Groceries

New Zealand is home to many fantastic restaurants, cafes and supermarkets packed with fresh groceries for stay-in dinners.

As we came to max out both of our Citi Rewards limits (S$1k each, S$2k total) for the month, we switched to the UOB KrisFlyer Card as the default card to be paired with Amaze to continue earning miles.

Shopping and Gifts

Who knew there was so much shopping to do in New Zealand? We even had to buy an extra luggage from The Warehouse to store our buys! For purchases made at retail stores, we used a mix of UOB Visa Signature, Citi Rewards and UOB KrisFlyer paired with Amaze throughout our trip.

Travel

While we redeemed our business class tickets, we still had to pay airport taxes. Other items included car rental + insurance, fuel, Uber rides in Queenstown, and the scenic TranzAlpine train tickets. Most of these purchases were made online hence we mainly used the DBS Women’s World Mastercard.

Additional perks

While we managed to earn 3-4mpd on our expenditure by using the cards listed above, there was one additional card we used to receive extra perks on our honeymoon – the AMEX Platinum Charge Card. Although it gives an unremarkably low earn rate of <1 mpd, it helped us to shave off hundreds of dollars in expenditure on our trip!

- Paid for our stay and dinner at Chateau on the Park DoubleTree by Hilton in Christchurch, which came with a $60 off $300 accumulative spend at participating Hilton properties.

- Dined virtually for free at two amazing restaurants – KIKA (>S$150) and Botswana Butchery (>S$200) – using the international dining credits (S$200) that came with annual fee payment for each card (we both own an AMEX Platinum Charge each).

- Booked our car rental from Hertz with our complimentary Hertz Gold Plus Rewards Membership for AMEX Platinum Charge cardholders. We received exclusive discounts and preferential rates when booking, and we even got a free tier upgrade! (booked a compact SUV but got a free upgrade to mid-sized SUV instead)

- We seized a promotion offered to AMEX card holders and managed to score $225 worth of Klook vouchers for only $135 (40% discount). We used it to purchase things like attraction tickets and SIM cards on Klook!

A whopping >30,000 miles earned and >S$1k savings!

While others may be busy enjoying their honeymoon, we saw it as an opportunity to continue our miles accumulation journey. We were able to maximise the miles earned by using the right credit cards for each spending category. We even managed to score free meals and secure discounts simply by virtue of owning a specific card!

Follow us on @keepthechange.ktc as we post more tips on our wedding, travels and renovation journey! Feel free to DM us if you have any questions and we are always happy to share!

Keep the Change

Tine & Hao

![[Upgraded] The 2 plus 1 card strategy to earn miles](https://keepthechangektc.com/wp-content/uploads/2024/09/4.png?w=1024)

Leave a comment