The realm of credit cards rewards is split into two camps – one filled with pragmatic individuals wanting fuss-free certainty over their rewards while the other consists of dreamers aspiring to make something bigger out of their rewards. Which camp do you belong to?

Should I Apply for Miles or Cashback Cards?

This is a question we often hear from our friends, and we’re here to simplify it for you in this post, while trying to be as objective as possible.

Cashback Cards

A cashback card does exactly what its name suggests: it gives you cash back based on your spending. For instance, a 5% cashback on an eligible $500 monthly spend means $25 will be credited to your bank account.

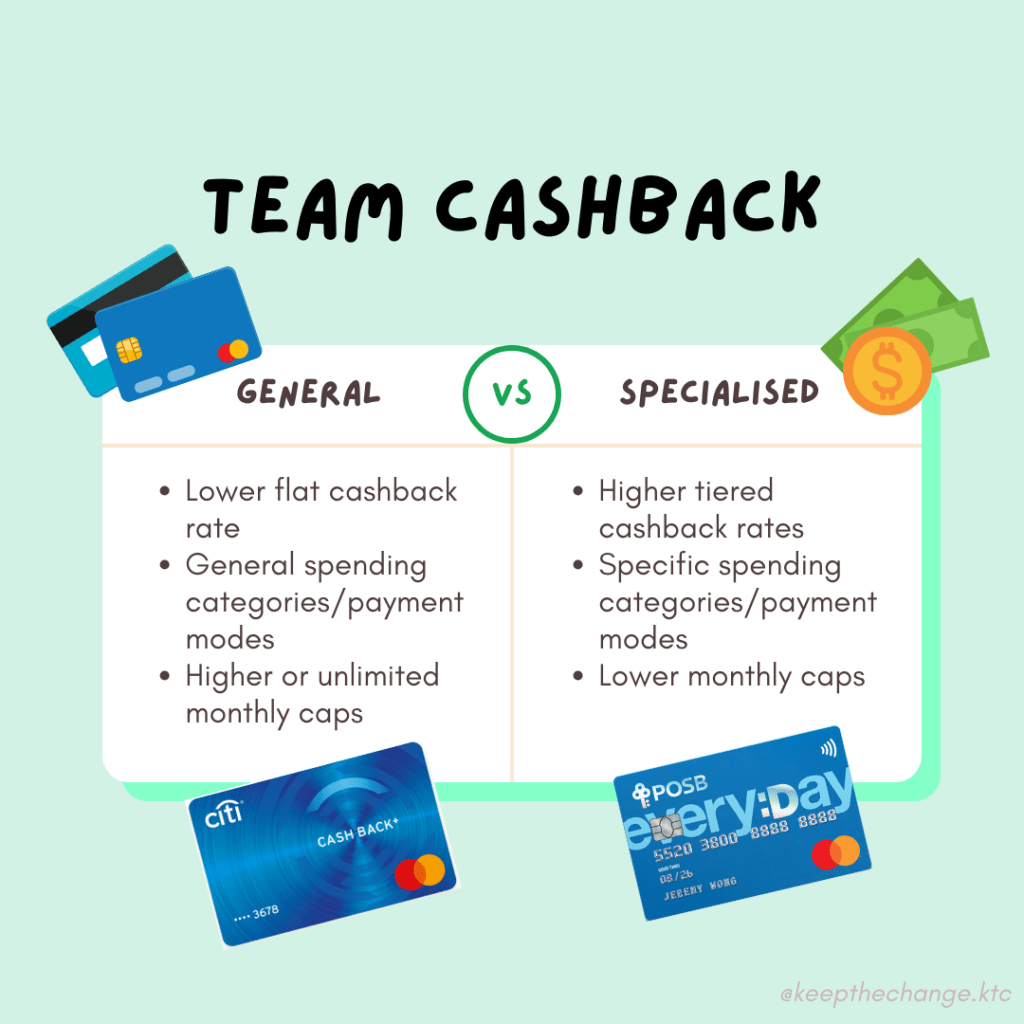

There are generally two types of cashback cards:

- General – These cards usually offer a relatively lower flat cashback rate for all categories without limits, such as the Citi Cash Back+ Card, which provides 1.6% cash back with no monthly minimum spend required and no limit on maximum spend.

- Specialised – These cards usually offer relatively higher cashback rates for spending in specific categories with limits. For example, the POSB Everyday Card offers up to 10% cash back on online food delivery at foodpanda and Deliveroo, and 3% cash back on other dining spend, with a requirement of at least S$800 qualified spend per month and a cap of $15 per month.

That sure sounded like a mouthful and if you find yourself as perplexed as we were initially, you’re not alone! Specialised cards often tout attractive rates but require you to get past many hurdles to actually get your hands on the cashback.

So when should you use these cards?

For day-to-day spending in major categories, stick to specialised cards to earn maximum cashback. General cards come in handy if you ever need to make a one-time large payment that exceeds specialised cards’ monthly limits.

Miles Cards

A miles card awards you miles (or rewards/points convertible to miles) that can be used to redeem flights and other rewards, such as hotel stays or retail products. Redeeming flights typically represents the best value-for-miles option.

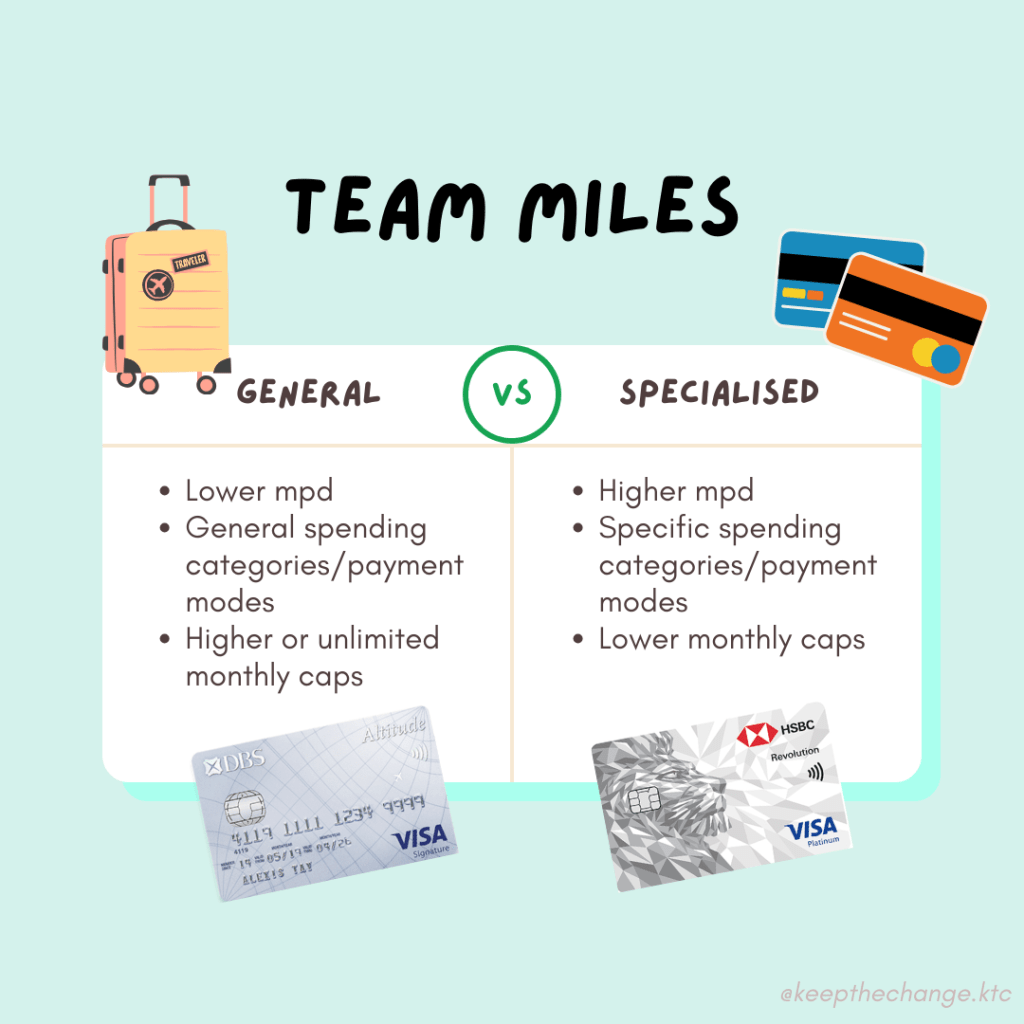

Similar to cashback cards, Miles cards come in two shapes:

- General – These cards usually offer relatively lower earn rates across a wide range of spending categories, with higher or unlimited caps. For example, the DBS Altitude Card awards you up to 2.2 mpd on overseas spend, and up to 1.3 mpd on local spend, with no limit on the number of miles you can earn in a month.

- Specialised – These cards usually come with relatively higher earn rates but are limited to specific spending categories/payment modes and often have low monthly caps. For instance, the HSBC Revolution Credit Card boasts a sweet 4 mpd earn rate, but is only capped at 4,000 miles per month, and must be for online spending at merchants that fall under one of these categories (1. Airlines, Car Rental, Lodging, Cruise Lines, 2. Department Stores & Retail Stores, 3. Dining and 4. Transport & Membership Clubs).

Why did we opt for Miles Instead of Cashback Cards?

That’s because we are dreamers! To us, miles are worth a lot more as compared to cashback!

While opting for miles means forgoing cashback, a quick calculation reveals that miles generally hold significantly more value.

For instance, as detailed in our previous posts, we spent S$54,000 on our banquet and accumulated about 400,000 miles. This haul is nearly sufficient to redeem SIX one-way business class flights from Singapore to New Zealand, valued at almost S$30,000 in total.

Even if we weren’t hell bent on flying business class and simply aimed for economy flights instead, we would have enough miles to redeem THIRTEEN flights from Singapore to New Zealand, with some miles to spare!

In contrast, if we had opted for cashback cards and hypothetically achieved a respectable cashback rate of 5%, we would have received $2,700 cashback in total. This amount would only be enough to purchase two economy flights or a single premium economy flight!

So… Miles or Cashback?

We hope we have provided you with the information you require to make the call between Miles or Cashback cards. Recall that we said at the beginning of this post that we will try to be as objective as we could? There is no polite way to say this but the decision between the two is pretty obvious… If you have been convinced to hop onboard the Miles train, stay tuned for our next post as we share how you can earn plenty of miles on your travels!

Keep The Change

Tine & Hao

![[Upgraded] The 2 plus 1 card strategy to earn miles](https://keepthechangektc.com/wp-content/uploads/2024/09/4.png?w=1024)

Leave a comment